Fdic

Aggregate data for all fdic insured institutions for each quarter back to 1984 in downloadable excel spreadsheet files.

Fdic. The federal deposit insurance corporation fdic is an independent agency created by the congress to maintain stability and public confidence in the nations financial system. The federal deposit insurance corporation fdic is one of two agencies that provide deposit insurance to depositors in us. The federal deposit insurance corporation fdic is the us. The fdic was.

If an insured bank fails then you wont lose the money you keep at that. Learn about the fdics mission leadership history career opportunities and more. Federal deposit insurance corporation fdic. Branch office deposits branch office deposits.

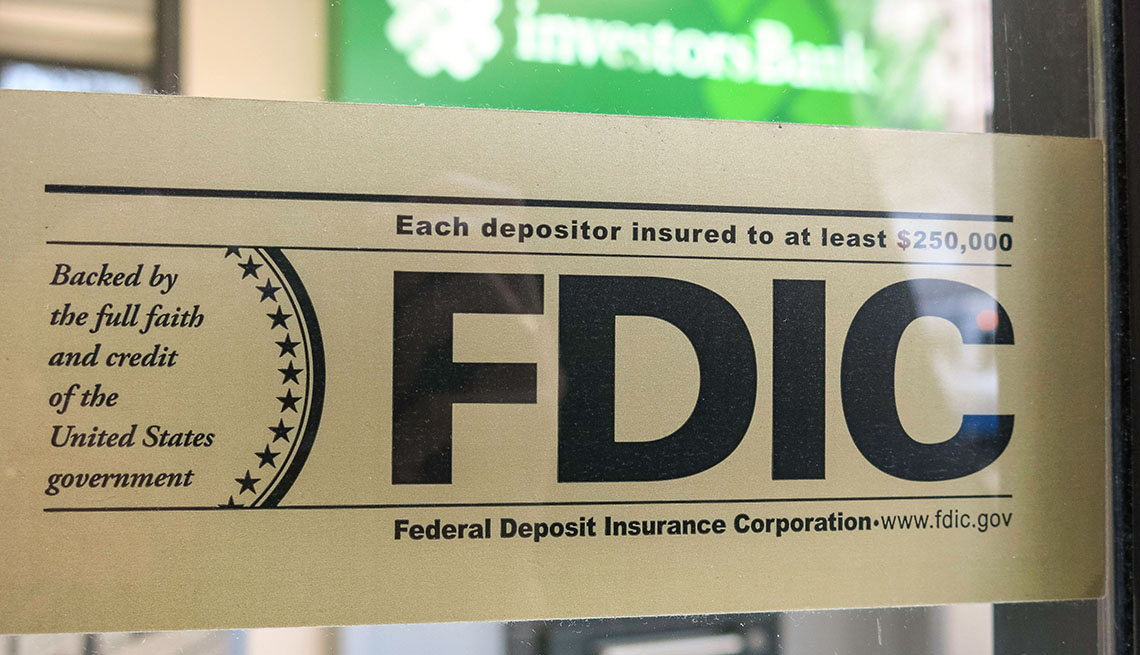

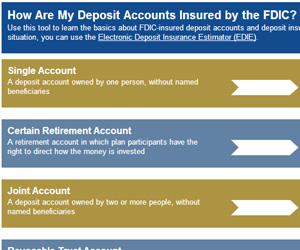

Commercial banks and savings banks. Learn about the fdics mission leadership history career opportunities and more. The federal deposit insurance corporation fdic is an independent agency created by the congress to maintain stability and public confidence in the nations financial system. This calculation is based on the deposit insurance regulations in effect as of july 2011.

Depository institutions the other being the national credit union administration which regulates and insures credit unionsthe fdic is a united states government corporation providing deposit insurance to depositors in us. The standard insurance amount is 250000 per. The federal deposit insurance corporation or fdic is a federal government agency that provides insurance to banks. The fdic or federal deposit insurance corporation is an agency created in 1933 during the depths of the great depression to protect bank depositors and ensure a level of trust in the american.

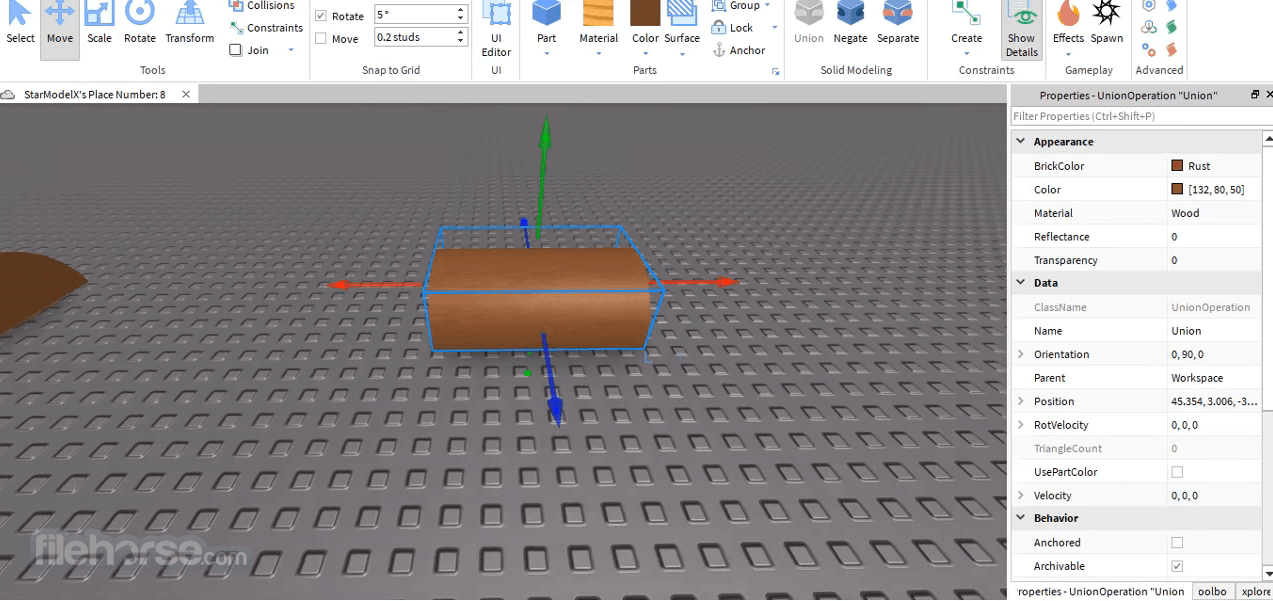

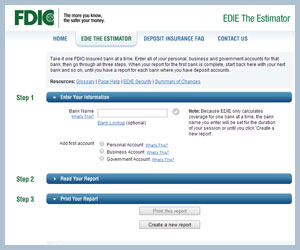

Welcome to the fdics electronic deposit insurance estimator edie. Corporation insuring deposits in the united states against bank failure. Data is available back to 1994. Edie is an interactive application that can help you learn about deposit insurance.

It allows you to calculate the insurance coverage of your accounts at each fdic insured institution.

:max_bytes(150000):strip_icc()/GettyImages-489614604-6cf7c070a91b4ef988255776bd32380f.jpg)

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)